George Washington: First in War, First in Peace, and First in the Hearts of his Countrymen more art

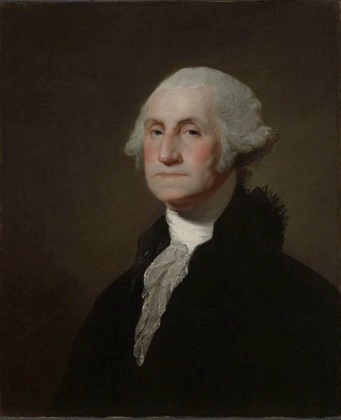

George Washington

A wagon load of money will scarcely purchase a wagon load of provisions.

George Washington (1732-1799)

1st President

— 1779 – Quoted by Albert S. Bolles, The Financial History of the United States (New York: D. Appleton, 1896, 4th ed.), Vol. I, pg. 132

John Adams

All the perplexities, confusions, and distresses in America arise not from defects in their Constitution or Confederation, not from the lack of honor or virtue, so much as from direct ignorance of the nature of coin, credit, and circulation.

John Adams (1735-1826)

2nd President

— Letter to Thomas Jefferson from Holland 1787

Portrait by John Trumbull

Alexander Hamilton

The tendency of a national bank is to increase public and private credit. The former gives power to the state, for the protection of its rights and interests: and the latter facilitates and extends the operation of commerce among individuals. Industry is increased, commodities are multiplied, agriculture and manufactures flourish: and herein consists the true wealth and prosperity of a state.

Alexander Hamilton (1755 or 1757-1804)

First Secretary of the Treasury

— Report on Manufactures 1790

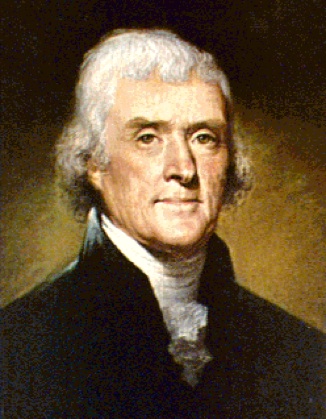

Thomas Jefferson

And I sincerely believe, with you, that banking establishments are more dangerous than standing armies; and that the principle of spending money to be paid by posterity, under the name of funding, is but swindling futurity on a large scale.

Thomas Jefferson (1743-1826)

Third President United States

— Letter to John Taylor, Monticello, 28 May 1816. Ford 11:533.

Thomas Hart Benton

Wise and prudent was the conduct of those who refused to recharter the second Bank of the United States. They profited by the error of their friends who refused to recharter the first one. These latter made no preparations for the event – did nothing to increase the constitutional currency – and did not even act until the last moment. The renewed charter was only refused a few days before the expiration of the existing charter, and the federal government fell back to the State banks, which immediately sunk under its weight. The men of 1832 acted very differently. They decided the question of the renewal long before the expiration of the existing charter. They revived the gold currency, which had been extinct for thirty years. They increased the silver currency by repealing the act of 1819 against the circulation of foreign silver. They branched the mints. In a word, they raised the specie currency from twenty millions to near one hundred millions of dollars; and thus supplied the country with a constitutional currency to take the place of the United States Bank notes. The supply was adequate, being nearly ten times the average circulation of the national bank. That average circulation was but eleven millions of dollars; the gold and silver was near one hundred millions. The success of our measures was complete. The country was happy and prosperous under it; but the architects of mischief – the political, gambling, and rotten parts of the banks, headed by the Bank of the United States, and aided by a political party – set to work to make panic and distress, to make suspensions and revulsions, to destroy trade and business, to degrade and poison the currency; to harass the country until it would give them another national bank: and to charge all the mischief they created upon the democratic administration. This has been their conduct; and having succeeded in the last presidential election, they now come forward to seize the spoils of victory in creating another national bank, to devour the substance of the people, and to rule the government of their people.

Thomas Benton (1782-1858)

Senator

–Thirty Years’ View, pg. 228, 1858

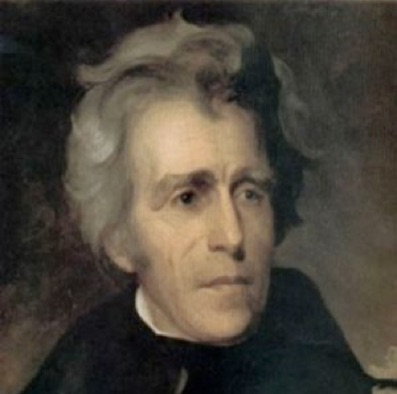

Andrew Jackson

I too have been a close observer of the doings of the Bank of the United States. I have had men watching you for a long time, and am convinced that you have used the funds of the bank to speculate in the breadstuffs of the country. When you won, you divided the profits amongst you, and when you lost, you charged it to the Bank. You tell me that if I take the deposits from the Bank and annul its charter I shall ruin ten thousand families. That may be true, gentlemen, but that is your sin! Should I let you go on, you will ruin fifty thousand families, and that would be my sin! You are a den of vipers and thieves. I have determined to rout you out and, by the Eternal, I will rout you out.

Andrew Jackson (1767-1845)

7th President of the United States

— From the original minutes of the Philadelphia committee of citizens sent to meet with President Jackson, February 1834, according to Stan V. Henkels, Andrew Jackson and the Bank of the United States, 1928

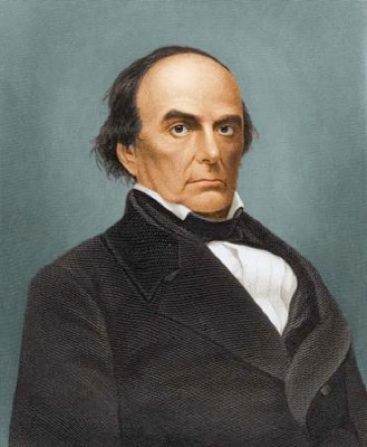

Daniel Webster

Of all the contrivances for cheating the laboring classes of mankind, none have been more effectual than that which deludes them with paper money. This is the most effectual of inventions to fertilize the rich man’s field by the sweat of the poor man’s brow. Ordinary tyranny, oppression, excessive taxation – these bear lightly on the happiness of the mass of the community compared with fraudulent currencies and the robberies committed by depreciated paper. Our own history has recorded for our instruction enough, and more than enough, of the demoralizing tendency, the injustice, and the intolerable oppression, on the virtuous and well disposed, of a degraded paper currency, authorized by law, or in any way countenanced by government.

Daniel Webster (1782-1852)

Senator

— Statement to Senate – 1832

Portrait by William Inman c.1830

Nicholas Biddle

My own course is decided. All other banks and all the merchants may break, but the Bank of the United States shall not break.

Nicholas Biddle (1786-1844)

President Second Bank of the United States

— Biddle to William Appleton, Jan,27,1834, and to J.G. Watmough, Feb.8,1834. Nicholas Biddle, Correspondence, 1807-1844, Reginald C. McGrane, ed. (New York: Houghton Mifflin, 1919), pp.219,221.

Abraham Lincoln

I have two great enemies, the Southern Army in front of me, and the financial institutions in the rear. Of the two, the one in my rear is my greatest foe.

Abraham Lincoln (1809-1865)

16th President of United States

— 1865, statement to Congress

Nelson W. Aldrich

Before the passage of this Act [Federal Reserve Act], the New York Bankers could only dominate the reserves of New York. Now we are able to dominate the bank reserves of the entire country.

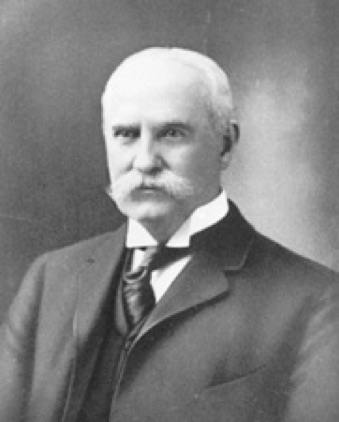

Nelson W. Aldrich (1841-1915)

Senator from Rhode Island 1881-1911 and Chairman of the National Monetary Commission

— Interview with The Independent magazine July 1914

Edward Mandell House

December 19, 1912 I talked with Paul Warburg over the telephone regarding the currency reform. I told of my Washington trip and what I had done there to get it into working order.

March 27, 1913 Mr. J.P. Morgan, Jr., and Mr. Denny of his firm, came promptly at five. McAdoo came about 10 minutes afterwards. Morgan had a currency plan already formulated and printed. We discussed it at some length. I suggested he have it type written [so it would not seem too prearranged] and sent to us today.

January 21, 1914 After dinner we [Wilson and House] went to the president’s study as usual and began work on the Federal Reserve Board appointments.

Edward Mandell House (1858-1938)

Senior Advisor to President Woodrow Wilson

— Charles Seymour – The Intimate Papers of Colonel Edward House (New York: Houghton Mifflin Co., 1926 Vol. I)

Louis T. McFadden

Mr. Chairman, we have in this country one of the most corrupt institutions the world has ever known. I refer to the Federal Reserve Board and the Federal Reserve Banks. The Federal Reserve Board, a government Board, has cheated the Government of the United States and the people of the United States out of enough money to pay the national debt. The depredations and iniquities of the Federal Reserve Board has cost this country enough money to pay the national debt several times over. This evil institution has impoverished and ruined the people of the United States, have bankrupted itself, and has practically bankrupted our government. It has done this through the defects of the law under which it operates, through the maladminisration of that law by the Federal Reserve Board, and through the corrupt practices of the moneyed vultures who control it.

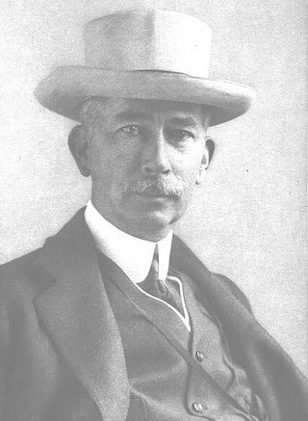

Louis T. McFadden (1875-1936)

Chairman of the United States House Committee on Banking and Currency (1920-1931)

— Speech in the House of Representatives 10 June 1932ward House (New York: Houghton Mifflin Co., 1926 Vol. I)

Ludwig von Mises

The Concept of money as a creature of the Law and the State is clearly untenable. It is not justified by a single phenomena of the market. To ascribe to the state the power of dictating the laws of exchange, is to ignore the fundamental principles of money-using society.

Ludwig von Mises (1881-1973)

Economist

— The Theory of Money and Credit, pg. 69, 1953

Charles A. Lindbergh Sr.

No one other consideration in connection with the business dealings of the people with each other is so important as the money and credit system. The authority for the money, as well as the support of credit, depends for its stability on the Government. In the extention of the advantages sought to be derived from the use of money and a practical use of credit the power of the Government is absolutely essential. Any proper considerations by Congress of this subject are necessarily national in scope.

It is the acme of absurdity for Congress to place between the people and the Government itself an agency in the absolute control of the distribution of money and the use of credit that would be valueless without the guaranty of the Government, and yet that is the identical thing that has been done by Congress, and the Glass bill emphasizes the absurdity.

Why should Congress place a controlling agency, employed for private gain, between the people and the Government of the United States? That is what has been done by giving to the banks the exclusive privilege of the use of the Government credit. Why is it proposed that the banker should take the merchants’, the manufactures’, and other notes, as well as the bonds of towns, villages, cities, States, and even the Nation’s bonds, to the Government and get currency, and at the same time refuse the producers themselves, the makers of the notes and obligations, an equal privilege? The absurdity of the Government giving away its own credit to corporations to exploit the people is incomprehensible. The bankers are not to blame. Congress is to blame for giving away the people’s rights and bestowing them upon the banks.

It is true that Congress possesses the authority and has the power to strip the banks of their exclusive monopoly, but the most of us have not the courage, and therefore we have the absurdity of the Congress of the United States giving to special interests the Government credit – the credit of the people – thereby forcing the people to borrow at exorbitant rates of interest the very money that their own Government issues on their own credit. The fiat of the Government is stamped upon the coins and the currency and then given to special interests and used as a means to pauperize the people. If the exclusive privilege were not given to the banks, then they would become the people’s natural agents, but with the exclusive monopoly they become the people’s masters.

Charles August Lindbergh Sr. (1859-1924)

Congressman from Minnesota 1907-1917

— Speech to House of Representatives Sept. 11 1913

Congressional Record Vol. 50 Part 5 pg. 4746

Franklin D. Roosevelt

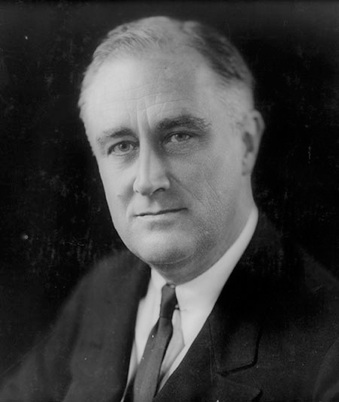

Yet our distress comes from no failure of substance. We are stricken by no plague of locusts. Compared with the perils which our forefathers conquered because they believed and were not afraid, we have still much to be thankful for. Nature still offers her bounty and human efforts have multiplied it. Plenty is at our doorstep, but a generous use of it languishes in the very sight of the supply. Primarily this is because the rulers of the exchange of mankind’s goods have failed, through their own stubbornness and their own incompetence, have admitted their failure, and abdicated. Practices of the unscrupulous money changers stand indicted in the court of public opinion, rejected by the hearts and minds of men.

True they have tried, but their efforts have been cast in the pattern of an outworn tradition. Faced by failure of credit they have proposed only the lending of more money. Stripped of the lure of profit by which to induce our people to follow their false leadership, they have resorted to exhortations, pleading tearfully for restored confidence. They know only the rules of a generation of self-seekers. They have no vision, and when there is no vision the people perish.

The money changers have fled from their high seats in the temple of our civilization. We may now restore that temple to the ancient truths. The measure of the restoration lies in the extent to which we apply social values more noble than mere monetary profit.

Franklin D. Roosevelt (1882-1945)

32nd President

— First Inaugural Address March 4 1933

John Maynard Keynes

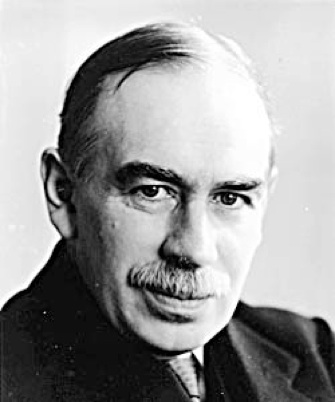

Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security, but at confidence in the equity of the existing distribution of wealth. Those to whom the system brings windfalls, beyond their deserts and even beyond their expectations or desires, become ‘profiteers,’ who are the object of the hatred of the bourgeoisie, whom the inflationism has impoverished, not less than of the proletariat. As the inflation proceeds and the real value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless; and the process of wealth-getting degenerates into a gamble and a lottery.

Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.

John Maynard Keynes (1883-1946)

Economist

— The Economic Consequences of the Peace, Chapter VI. pg. 235-236, 1919

John William Wright Patman

The power to create money is an inherent power of government. As President Lincoln said:

“The privilege of creating and issuing money is not only the supreme prerogative of the government, it is the Governments greatest opportunity.”

During the past several centuries, various governments in the Western World have, at various times, delegated the money-creating power to private groups or had this power taken from them by default. In these situations, control of the Nations affairs has been not so much in the hands of the official head of state, but in the hands of the private groups controlling the money system. A famous British banker once summed up the matter this way:

“They who control the credit of the nation direct the policy of governments, and hold in their hands the destiny of the people.”

Reginald Mckenna, Chancellor of the Exchequer of Britain during the WWI period.

As we look over human history, we find the tribal chief, the king, the pharaoh, or the emperor has usually had direct or indirect control of the society’s money. In the modern, constitutional governments, one or another branch of the government is given responsibility for establishing and managing the money system. In the United States, the Constitution gives these powers to Congress.

John William Wright Patman (1893-1976)

Chairman of the United States House Committee on Banking and Currency (1965-1975)

— Primer on Money pg. 24, 1964 Produced by the Subcommittee on Domestic Finance

Paul Warburg

While technically and legally the Federal Reserve note is an obligation of the United State Government, in reality it is an obligation, the sole actual responsibility for which rests on the reserve banks… The government could only be called upon to take them up after the reserve banks had failed.

Paul Warburg(1886-1932)

Financier

— The Federal Reserve System: Its Origin and Growth (New York: MacMillen,1930 Vol I pg. 409)

Milton Friedman

There is enormous inertia – a tyranny of the status quo – in private and especially governmental arrangements. Only a crisis – actual or perceived – produces real change. When that crisis occurs, the activities that are taken depend on the ideas laying around. That, I believe, is our basic function: to develop alternatives to existing policies, to keep them alive and available until the politically impossible becomes the politically inevitable.

Milton Friedman (1912-2006)

Economist Nobel Prize Economics 1976

— Capitalism and Freedom 1962, Preface pg. ix. 1982 Edition

Friedrich August von Hayek

Inflation is probably the most important single factor in that viscous circle wherein one kind of government action makes more and more government control necessary. For this reason all those who wish to stop the drift toward increasing government control should concentrate their effort on monetary policy.

Friedrich August von Hayek (1899-1992)

Economist Nobel Prize 1974

— The Constitution of Liberty, pg.338-339, 1960

Murray Rothbard

The Federal Reserve Act of December 23, 1913, was part and parcel of the wave of Progressive legislation on local, state, and federal levels of government that began about 1900. Progressivism was a bipartisan movement that, in the course of the first two decades of the 20th century, transformed the American economy and society from one of roughly laissez-faire to one of centralized statism.

Until the 1960s, historians had established the myth that Progressivism was a virtual uprising of workers and farmers who, guided by a new generation of altruistic experts and intellectuals, surmounted fierce big business opposition in order to curb, regulate, and control what had been a system of accelerating monopoly in the late nineteenth century. A generation of research and scholarship, however, has now exploded that myth for all parts of the American polity, and it has become all too clear that the truth is the reverse of this well worn fable.

In contrast, what actually happened was that business became increasingly competitive during the late 19th century, and that various big-business interests, led by the powerful financial house of J. P. Morgan and Company, tried desperately to establish successful cartels on the free market. The first wave of such cartels was in the first large-scale business — railroads. In every case, the attempt to increase profits — by cutting sales with a quota system — and thereby to raise prices or rates, collapsed quickly from internal competition within the cartel and from external competition by new competitors eager to undercut the cartel.

Murray Rothbard (1926-1995)

Economist/Historian

— The Origins of the Federal Reserve pg. 1, 1999

Ayn Rand

Both the “conservatives” and the “liberals” stress a fact with which everybody seems to agree: that the world is facing a deadly conflict and that we must fight to save civilization.

But what is the nature of that conflict? Both groups answer: it is a conflict between communism and … what? – blank out. It is a conflict between two idealogies, they answer. What is our ideology? Blank out.

The truth which both groups refuse to face and to admit is that, politically, the world conflict of today is the last stage of the struggle between capitalism and statism.

We stand for freedom, say both groups – and proceed to declare what kind of controls, regulations, coercions, taxes, and “sacrifices” they would impose, what arbitrary powers they would demand, what “social gains” they would hand out to various groups, without specifying from what other groups these “gains” would be expropriated. Neither of them cares to admit that government control of a country’s economy – any kind or degree of such control, by any group, for any purpose whatsoever – rests on the basic principle of statism, the principle that man’s life belongs to the state. A mixed economy is merely a semi-socialized economy – which means: a semi-enslaved society – which means: a country torn by irreconcilable contradictions, in the process of gradual disintegration.

Ayn Rand (1905-1982)

Philosopher, Writer

— From a Lecture given at Princeton University in 1960

Paul Volcker

I want to leave you with one other thought, which may make some central banks inconsequential. What is the endgame in all of this, of open markets: the free flow of capitol around the world, a couple of hundred independent countries, some big, some small? I think the logical long-term result – extending far beyond my living horizon, but perhaps not yours – is a world currency. With a world currency, we will not have a lot of central banks. What I have not quite figured out is what the one remaining central bank will do, what instruments it will use, and how it will be controlled. But I think that is the direction in which economic and financial logic guide us.

Paul Volcker (1927 -)

12th Federal Reserve Chairman

— Monetary Policy Transmission: Past and Future Challenges, To Conference on Financial Innovation and Monetary Transmission April 2002

Allen Greenspan

Of course, shedding the debt burden would be a happy development for our country, but it would nevertheless pose a big dilemma for the Fed (Federal Reserve). Our primary lever of monetary policy was buying and selling treasury securities – Uncle Sam’s IOU’s. But as the debt was paid down, those securities would grow scarce, leaving the Fed in need of a new set of assets to effect monetary policy.

Allen Greenspan (1926-)

13th Chairman of the Federal Reserve

— The Age of Turbulence Chpt. 10 pg. 214, 2007

Ron Paul

The Founders of this Country, and a large majority of the American people up until the 1930s, disdained paper money, respected commodity paper, and disproved of a central bank’s monopoly control of money creation and interest rates. Ironically, it was the abuse of the gold standard, the Fed’s credit creating habits of the 1920s, and its subsequent mischief in the 1930s, that not only gave us the Great Depression, but also prolonged it. Yet sound money was blamed for all the suffering. That’s why people hardly objected when Roosevelt and his statist friends confiscated gold and radically debased the currency, ushering in the age of worldwide fiat currencies with which the international economy struggles today.

Ron Paul (1935- )

Chairman of the House Financial Services Subcommittee on Domestic Monetary Policy

— Speech in the House of Representatives 5 September 2003

Ben Bernanke

Like gold U.S. dollars have value only to the extent that they are strictly limited in supply. But the U.S. government has a technology, called a printing press (or today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost. By increasing the number of U.S. dollars in circulation, or even by credibly threatening to do so, the U.S. government can also reduce the value of a dollar in terms of goods and services. We conclude that, under a paper-money system, a determined government can always generate higher spending and hence positive inflation.

Ben Bernanke (1953- )

14th Chairman of the Federal Reserve

— Remarks Before the National Economists Club 21 November 2002

Thomas Sowell

Despite all the political rhetoric today about how nobody’s taxes will be raised, except for “the rich,” inflation transfers a percentage of everybody’s wealth to a government that expands the money supply.

Moreover, inflation takes the same percentage from the poorest person in the country as it does from the richest.

That’s not all. Income taxes only transfer money from your current income to the government, but it does not touch whatever money you may have saved over the years. With inflation, the government takes the same cut out of both.

It is bad enough when the poorest have to turn over the same share of their assets to the government as the richest do, but it is grotesque when the government puts a bigger bite on the poorest. This can happen because the rich can more easily convert their assets from money into things like real estate, gold or other assets whose value rises with inflation.

But a welfare mother is unlikely to be able to buy real estate or gold. She can put a few dollars aside in a jar somewhere. But wherever she may hide it, inflation can steal value from it without having to lay a hand on it.

No wonder the Federal Reserve uses fancy words like “quantitative easing,” instead of saying in plain English that they are essentially just printing more money.

Thomas Sowell (1930- )

Economist

— “Taxing the Poor” Creators Syndicate Inc. Written 10 December 2012