Dedicated to providing news and information about monetary policy.

Murray Rothbard

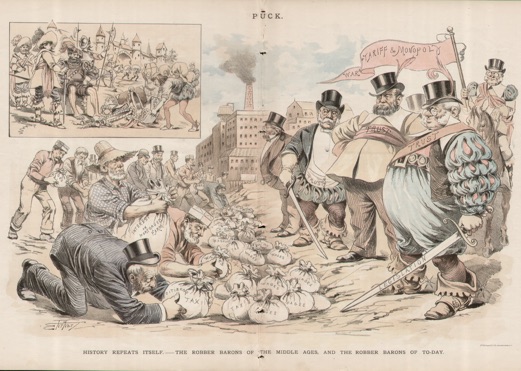

The financial elites of this country, notably the Morgan, Rockefeller, and Kuhn, Loeb interests, were responsible for putting through the Federal Reserve System, as a governmentally created and sanctioned cartel device to enable the nation’s banks to inflate the money supply in a coordinated fashion, without suffering quick retribution from depositors or note holders demanding cash. Recent researchers, however, have also highlighted the vital supporting role of the growing number of technocratic experts and academics, who were happy to lend the patina of their allegedly scientific expertise to the elite’s drive for a central bank. To achieve a regime of big government and government control, power elites cannot achieve their goal of privilege through statism without the vital legitimizing support of the supposedly disinterested experts and the professoriat. To achieve the Leviathan State, interests seeking special privilege, and intellectuals offering scholarship and ideology, must work hand in hand.

Reflections

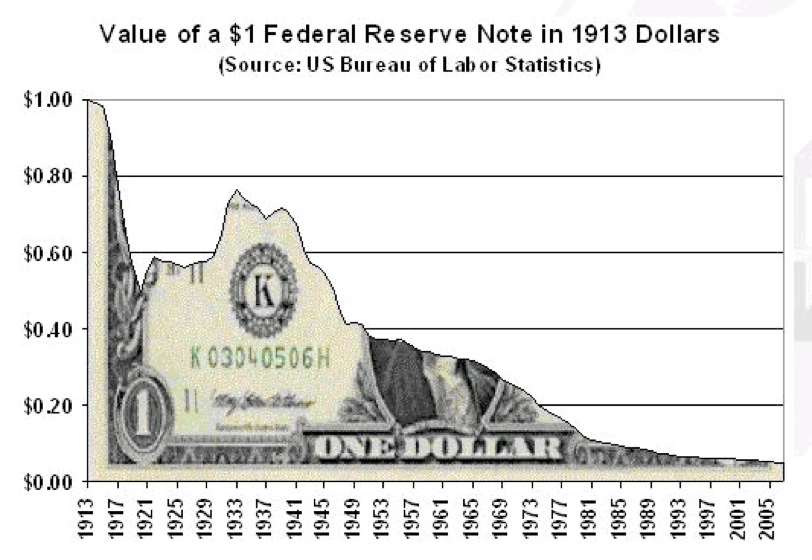

Since the financial crisis of 2007-2008 the Federal Reserve Bank of New York has created over $40,000,000,000,000 dollars out of thin air and injected that money into Wall Street and foreign banks. That 40 trillion dollars divided by 330 million people in the United States comes out to roughly $120,000 per person. So as our Federal politicians congratulate themselves about saving the day the giving everybody $1,200 dollars please realize that the vast majority of the American people are getting a tiny fraction of money from the Federal Reserve bailout that never seems to end. And [...]

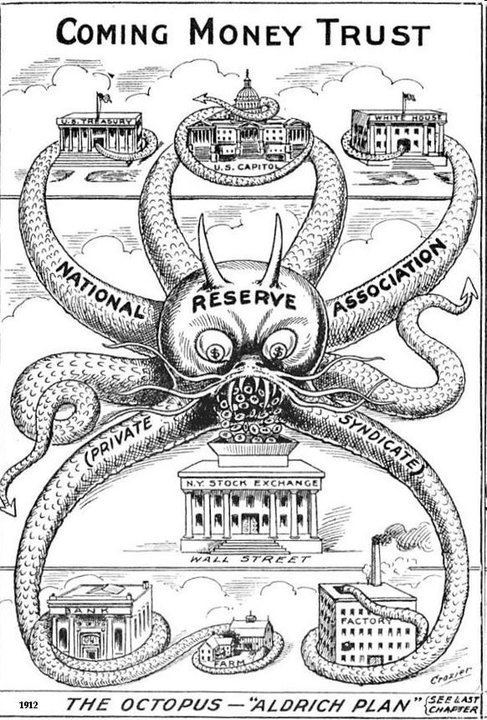

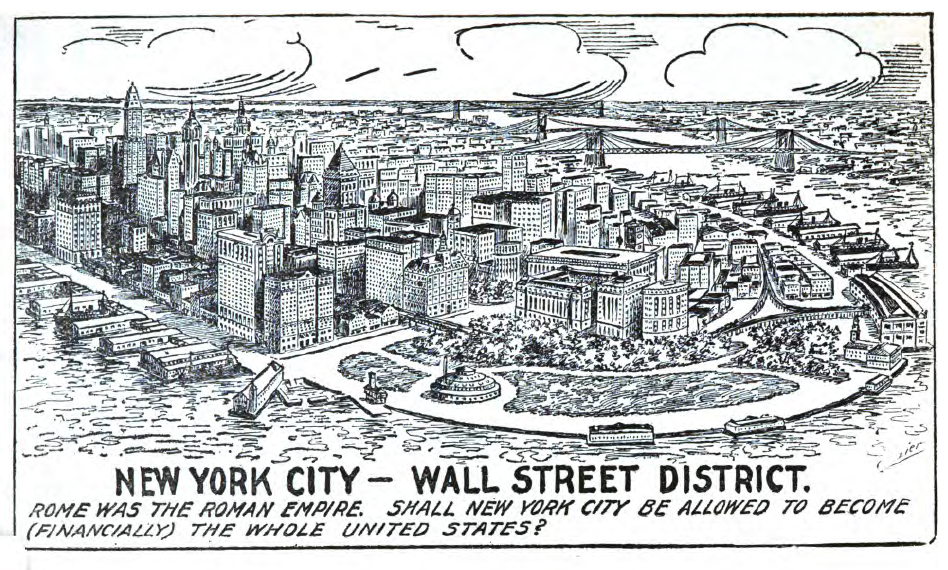

A little over 100 years ago Wall Street gained control of the United States money supply and credit with the creation of the Federal Reserve System and began the process of conquering America. The power of The Federal Reserve has grown exponentially in the last 15 years and it is now the most powerful institution in America controlling the spending of tens of trillions of dollars. This website attempts to provide information about the creation of The Federal Reserve System.

As seen in the above quote by the eminent economic historian Murray Rothbard the Fed was “a governmentally created and sanctioned cartel device to enable the nation’s banks to inflate the money supply in a coordinated fashion, without suffering quick retribution from depositors or note holders demanding cash.” The book The Origins of the Federal Reserve by Murray Rothbard is a great introduction to this subject.

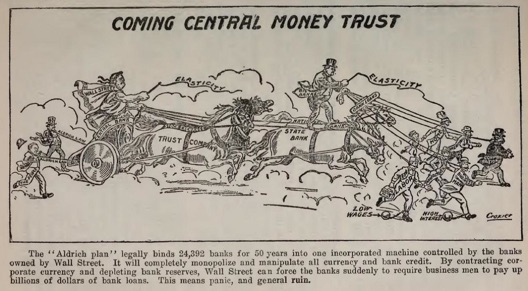

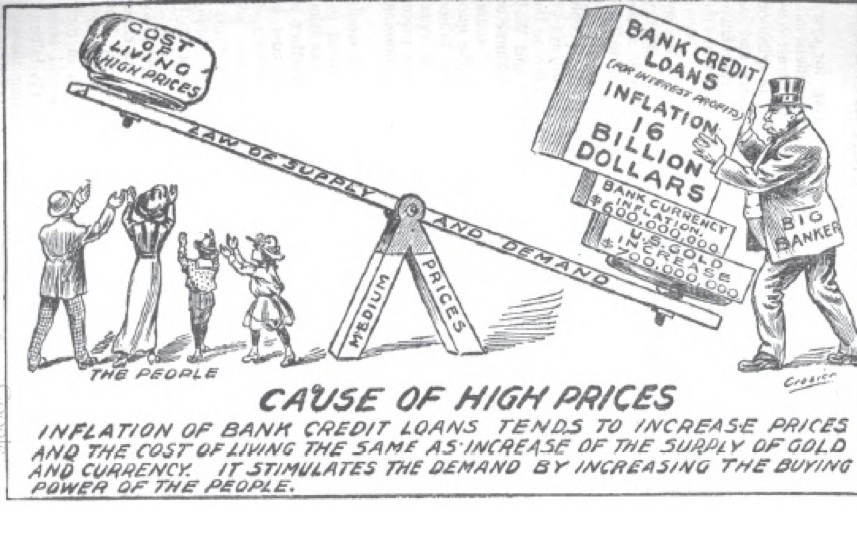

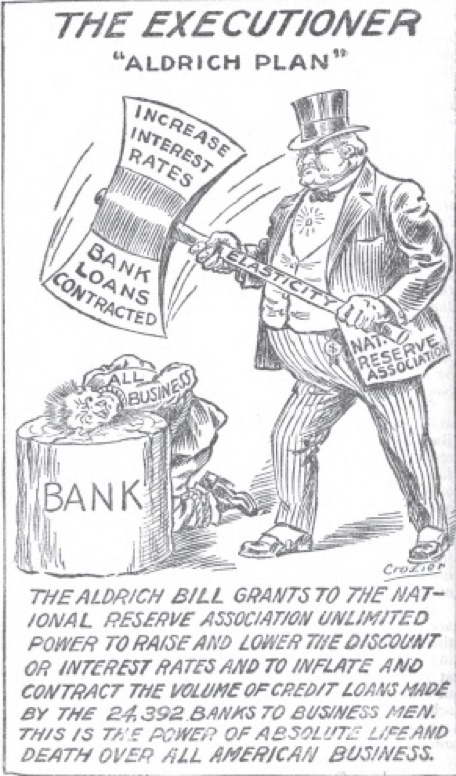

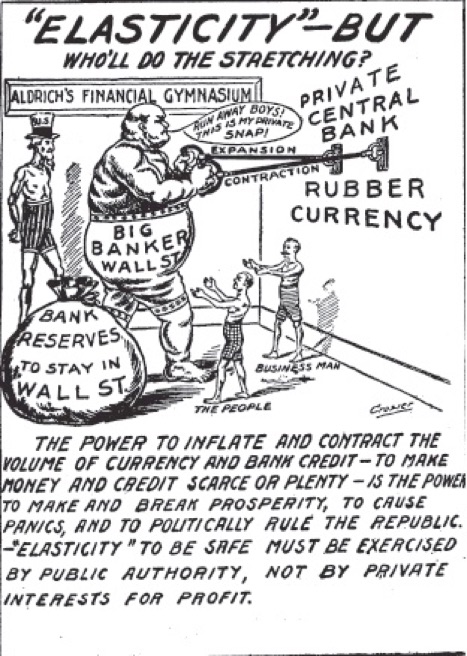

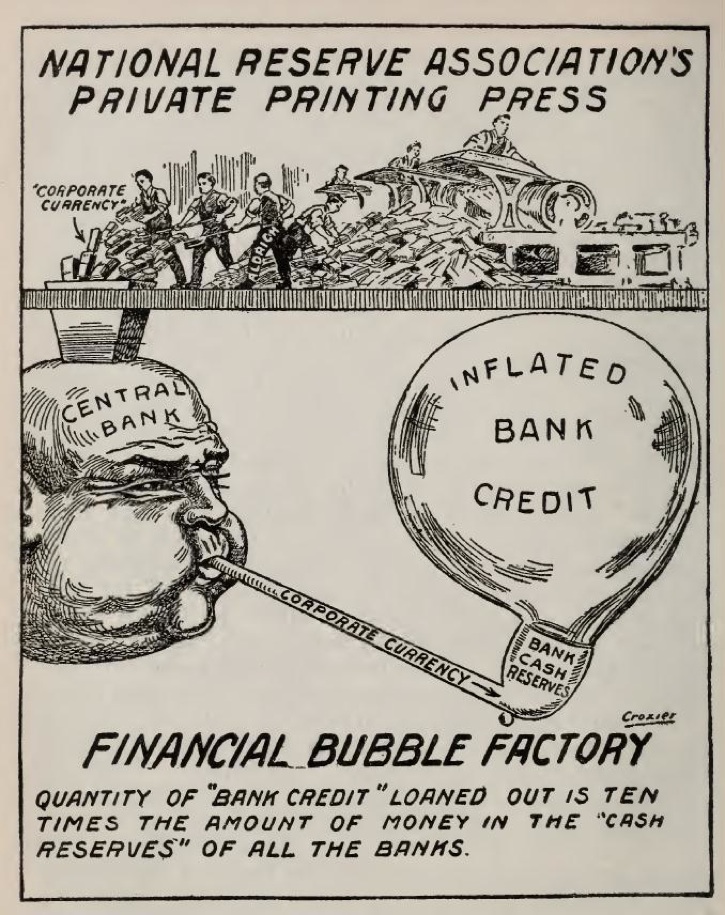

The Money Trust that is depicted in the pictures shows the danger that is inherent in giving bankers and financiers control of a Nations money supply and credit. That danger has now come full circle with the Federal Reserve in almost complete control of the United States economy and the owners of the Federal Reserve Bank of New York in complete control of the United States Congress. The “Aldrich Plan” in the pictures was named after Senator Nelson W. Aldrich and was the basis of the Federal Reserve Act that passed into law in 1913. The Federal Reserve Act created 12 regional Federal Reserve Banks and a Board of Governors in Washington DC. Of the 12 regional Reserve Banks in the United States the Federal Reserve Bank of New York is by far the dominant bank and the other 11 Reserve Banks are more like think tanks that get an occasional vote on monetary policy questions. With the creation of the Federal Reserve Act our Federal Government elevated a tiny number of people in New York City to be the most privileged people in our society with the control of a government approved printing press. It is the Federal Reserve Bank of New York that has control of this most valuable government enforced privilege. The largest owners of the Federal Reserve Bank of New York are JPMorgan Chase, Citigroup, Goldman Sachs, Morgan Stanley, and Bank of New York Mellon. This story from Wall Street on Parade gets into more detail about the ownership of the New York Fed These Are the Banks that Own the New York Fed and Its Money Button. This arrangement is in fact “privilege through statism” in its purist form and any attempt to take away this extraordinary privilege and reform the current system of monetary policy would be met with ferocious resistance by those attempting to retain their government granted privileges.

When the Federal Reserve Act was being debated in Congress Senator Francis Newlands of Nevada led a coalition of Senators that wanted to create a system that had a Reserve Bank and financial center in every State. Unfortunately the bankers and financiers in New York City won the day and seized control and the United States money supply and credit. The ultimate source of Wall Street’s power is the Federal Reserve Bank of New York – the only Reserve Bank with a permanent vote on monetary policy questions – and the government granted privileges which make the New York Fed so incredibly valuable. Until the Federal Reserve System is abolished and a new system is created the power of Wall Street is going to continue to grow unbounded. The solution to this problem is to decentralize monetary power from New York to the rest of the States. If it is possible to create a State Reserve System where we scale up our current system to one where every State has a permanent vote on monetary policy questions and the weight of that vote is tied to the population of the State we will have created a much fairer and more equitable system of monetary policy.

___________________________________________________________

News 8/7/2020

Friday, August 7, 2020

Nightmare For Bullion Banks Continues As Silver Hits $30 In Overseas Trading And Gold Surges Toward $2,100

King World News by Alasdair Macleod 8/6/2020

Fed, Treasury feel heat from lawmakers on ‘Main Street’ design

Politico by Victoria Guida 8/6/2020

Fascinating Examples Of How Blockchain Is Used In Insurance, Banking And Travel

Forbes by Bernard Marr 8/5/2020

Bitcoin Price Rises 3% as Gold Trades Above $2K for First Time

coindesk by Omkar Godbole 8/5/2020

Paul Krugman’s Ad Hominem Defense of Central Banking

The Heartland Institute by Richard Ebeling 8/4/2020

China Pushes for Blockchain Dominance But Will the World Go for It?

Voice of America by John Xie 7/30/2020

Bank of Japan doubles down on a digital yen

Decrypt by Robert Stevens 7/29/2020

Just 3% of top financial regulators in last 106 years were Black

yahoo!money by Brian Cheung 7/28/2020

The Nation Is Falling Into the Abyss Between Wall Street and Main Street

Of Two Minds by Charles Hugh Smith 7/28/2020

Fed board pick Judy Shelton moves closer to confirmation

Axios by Courtenay Brown 7/21/2020

How the US Federal Reserve created a financial opioid crisis in the West

South China Morning Post by Andy Xie 7/17/2020

The Federal Reserve Has Its Own Police and is Part of a Vast Surveillance Center – Should You Worry?

Wall Street on Parade by Pam Martens and Russ Martens 7/15/2020

News 5/30/2020

Saturday, May 30, 2020

Unsanitized: BlackRock Is Buyer and Seller

The American Prospect by David Dayen 5/30/2020

The Worst Crisis in a Century Is Setting the Stage for Bitcoin

CoinTelegraph by Jay Has 5/29/2020

Chasing After the Fed, ETF Investors Dive into Corporate Bonds

ETF Trends by Max Chen 5/29/2020

Sideways: BlackRock Basking in the Extraordinary Privileges Bestowed Upon it by the United States federal government and the Federal Reserve

EuroMoney by Jon Macaskill 5/28/2020

U.S. judge orders 15 banks to face big investors’ currency rigging lawsuit

Reuters by Jonathan Stemple 5/28/2020

Do You Feel $9,000 Richer, Punk?

Reason by Matt Welch 5/28/2020

How the Federal Reserve’s Rescue Program Is Worsening Inequality

Politico by Gene Ludwig and Sarah Bloom Raskin 5/28/2020

Inside the 2.5 Trillion Debt Binge That Has Taken S&P 500 Titans Including Boeing and AT&T From Blue Chips to Near Junk

Forbes by Antoine Gara and Nathan Vardi

Nomi Prins: Big Banks Got the Sweetest Deal from the Covid-19 Bailouts

SCHEERPOST by Robert Scheer 5/15/2020

Blockchain’s next frontier: Shaping the business model

MIT Technology Review by Linda Pawczuk 5/14/2020

How the COVID-19 Bailout Gave Wall Street a No-Lose Casino

Rolling Stone by Matt Taibbi 5/13/2020

An unleashed Federal Reserve is a threat to liberty and free markets

The Orange County Register by Ron Paul 5/4/2020

Go to archive

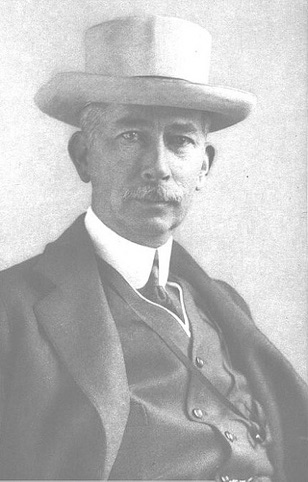

Bertie Charles Forbes

Picture a party of the nation’s greatest bankers stealing out of New York on a private railroad car under the cover of darkness stealthily hieing hundreds of miles South, embarking on a mysterious launch, sneaking on to an island deserted by all but a few servants, living there a full week under such rigid secrecy that the names of not one of them was mentioned lest the servants learn the identity and disclose to the world this strangest, and most secret expedition in the history of American finance.

I am not romancing. I am giving to the world, for the first time, the real story of how the famous Aldrich currency report, the foundation of our new currency, was written.

Bertie Charles Forbes (1880-1954)

Financial journalist, author, founder Forbes Magazine

“Men Who Are Making America,” Leslie’s Weekly, October 19, 1916, p. 423

The Aldrich currency report that is mentioned in the above quote was designed by Senator Aldrich and the men who accompanied him to Jekyll Island, Georgia. It was the Aldrich currency report that formed the basis of the Federal Reserve Act. The seven people who had a seat at the table when the Aldrich currency report was written were:

Senator Nelson W. Aldrich – U.S. Senator

Henry P. Davison – senior partner J.P. Morgan

Frank A. Vanderlip – president of National City Bank of New York

Charles D. Norton – president of J.P. Morgan’s First National Bank of New York

Benjamin Strong – of J.P. Morgan’s Bankers Trust Company

Abraham Piatt Andrew – Assistant Secretary of the U.S. Treasury

Paul M. Warburg – partner in Kuhn, Loeb & Company

Over twenty years later Frank Vanderlip decided to write about his trip to Jekyll Island with Senator Aldrich and admitted that if the public had found out about the secret meeting there would have been no chance of the United States Congress voting to approve the Federal Reserve Act which had been written by New York City’s most powerful bankers.

Frank A. Vanderlip

Once aboard the private car we began to observe the taboo that had been fixed on last names. We addressed one another as “Ben,” “Paul,” “Nelson,” ”Abe” – it is Abraham Piat Andrew. Davison and I adopted even deeper disguises, abandoning our first names. On the theory that we were always right, he became Wilbur and I became Orville, after those two aviation pioneers, the Wright brothers. Incidentally, for years afterward Davison and I continued the practice, in communications, and when we were together.

The servants and train crew may have known the identities of one or two of us, but they did not know all, and it was the names of all printed together that would have made our mysterious journey significant in Washington, in Wall Street, even in London. Discovery, we knew, simply must not happen, or else all our time and effort would be wasted. If it were to be exposed publicly that our particular group had got together and written a banking bill, that bill would have no chance whatever of passage by Congress.

Frank A. Vanderlip (1864-1937)

Financier

From Farm Boy to Financier,” The Saturday Evening Post, pg. 70, Feb. 9, 1933

Paul M. Warburg

Though eighteen years have gone by, I do not feel free to give a description of this most interesting conference which Senator Aldrich pledged all participants to secrecy.

Paul Warburg(1886-1932)

Financier

— The Federal Reserve System: Its Origin and Growth (New York: MacMillen, 1930), Vol. I, pg. 58

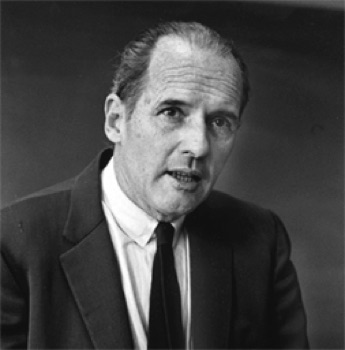

John William Wright Patman

The power to create money is an inherent power of government. As President Lincoln said:

“The privilege of creating and issuing money is not only the supreme prerogative of the government, it is the Governments greatest opportunity.”

During the past several centuries, various governments in the Western World have, at various times, delegated the money-creating power to private groups or had this power taken from them by default. In these situations, control of the Nations affairs has been not so much in the hands of the official head of state, but in the hands of the private groups controlling the money system. A famous British banker once summed up the matter this way:

“They who control the credit of the nation direct the policy of governments, and hold in their hands the destiny of the people.”

Reginald Mckenna, Chancellor of the Exchequer of Britain during the WWI period.

As we look over human history, we find the tribal chief, the king, the pharaoh, or the emperor has usually had direct or indirect control of the society’s money. In the modern, constitutional governments, one or another branch of the government is given responsibility for establishing and managing the money system. In the United States, the Constitution gives these powers to Congress.

John William Wright Patman (1893-1976)

Chairman of the United States House Committee on Banking and Currency (1965-1975)

— Primer on Money pg. 24, 1964 Produced by the Subcommittee on Domestic Finance

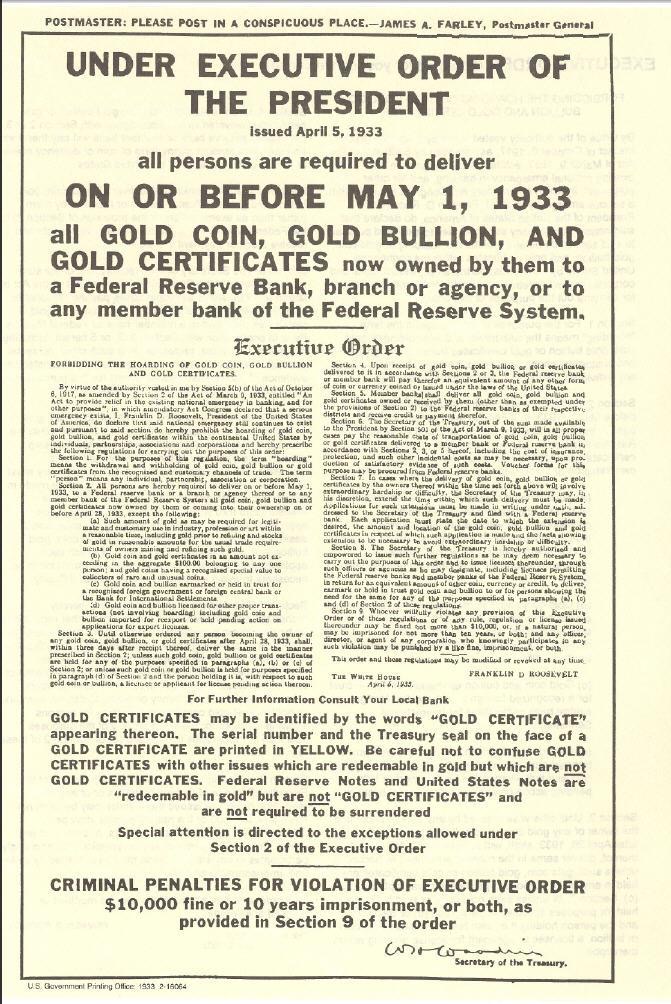

Congressman Ron Paul is referring to the Executive Order above signed by

President Roosevelt. At this time the Federal Government confiscated the

gold of the American people and transferred all of that gold to the

Federal Reserve System.

Ron Paul

The Founders of this Country, and a large majority of the American people up until the 1930s, disdained paper money, respected commodity paper, and disproved of a central bank’s monopoly control of money creation and interest rates. Ironically, it was the abuse of the gold standard, the Fed’s credit creating habits of the 1920s, and its subsequent mischief in the 1930s, that not only gave us the Great Depression, but also prolonged it. Yet sound money was blamed for all the suffering. That’s why people hardly objected when Roosevelt and his statist friends confiscated gold and radically debased the currency, ushering in the age of worldwide fiat currencies with which the international economy struggles today.

Ron Paul (1935- )

Chairman of the House Financial Services Subcommittee on Domestic Monetary Policy

— Speech in the House of Representatives 5 September 2003

Links to more:

Important Figures Constitutional Issues Congressional Record

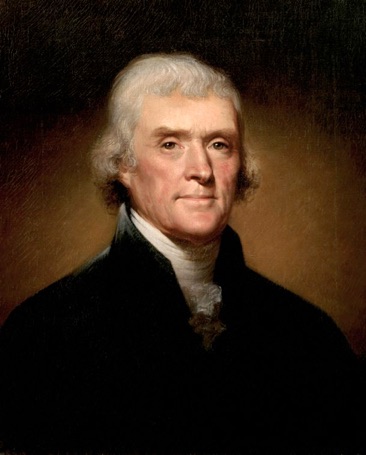

Thomas Jefferson

And I sincerely believe, with you, that banking establishments are more dangerous than standing armies; and that the principle of spending money to be paid by posterity, under the name of funding, is but swindling futurity on a large scale.

Thomas Jefferson (1743-1826)

Third President United States

— Letter to John Taylor, Monticello, 28 May 1816. Ford 11:533.

Thomas Hart Benton

Wise and prudent was the conduct of those who refused to recharter the second Bank of the United States. They profited by the error of their friends who refused to recharter the first one. These latter made no preparations for the event – did nothing to increase the constitutional currency – and did not even act until the last moment. The renewed charter was only refused a few days before the expiration of the existing charter, and the federal government fell back to the State banks, which immediately sunk under its weight. The men of 1832 acted very differently. They decided the question of the renewal long before the expiration of the existing charter. They revived the gold currency, which had been extinct for thirty years. They increased the silver currency by repealing the act of 1819 against the circulation of foreign silver. They branched the mints. In a word, they raised the specie currency from twenty millions to near one hundred millions of dollars; and thus supplied the country with a constitutional currency to take the place of the United States Bank notes. The supply was adequate, being nearly ten times the average circulation of the national bank. That average circulation was but eleven millions of dollars; the gold and silver was near one hundred millions. The success of our measures was complete. The country was happy and prosperous under it; but the architects of mischief – the political, gambling, and rotten parts of the banks, headed by the Bank of the United States, and aided by a political party – set to work to make panic and distress, to make suspensions and revulsions, to destroy trade and business, to degrade and poison the currency; to harass the country until it would give them another national bank: and to charge all the mischief they created upon the democratic administration. This has been their conduct; and having succeeded in the last presidential election, they now come forward to seize the spoils of victory in creating another national bank, to devour the substance of the people, and to rule the government of their people.

Thomas Benton (1782-1858)

Senator

–Thirty Years’ View, pg. 228, 1858

Aristotle

The most hated sort of such exchange is … usury, which makes a gain out of money itself, and not from its natural use. For money was intended as an instrument of exchange, and not as the mother of interest. This usury (tokos), which means the birth of money from money, … is of all modes of gain the most unnatural.

Aristotle (384–322 BC)

Philosopher

Politics Part X (335–323 BC)

The Stanford Encyclopedia of Philosophy

Philosophy of Money and Finance

The Money Trust was born in 1913 with the creation of the Federal Reserve System. That was when the Congress of the United States, and President Woodrow Wilson, decided to give control of the United States’ money supply and credit to bankers and financiers on Wall Street. The Federal Reserve is owned by the big banks on Wall Street and has a coercive government monopoly to operate. Below is a revealing quote from Nelson Aldrich, of the “Aldrich Plan” in the picture above, one of the driving forces behind The Federal Reserve Act in Congress.

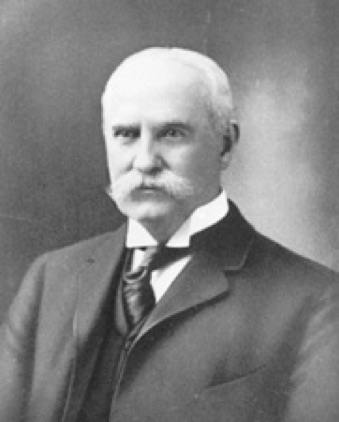

Nelson W. Aldrich

Before the passage of this Act [Federal Reserve Act], the New York Bankers could only dominate the reserves of New York. Now we are able to dominate the bank reserves of the entire country.

Nelson W. Aldrich (1841-1915)

Senator from Rhode Island 1881-1911

Chairman of the National Monetary Commission

— Interview with The Independent magazine July 1914

Charles A. Lindbergh Sr. was a Congressman in the U.S. House of Representatives. He opposed the Federal Reserve Act because he believed giving the bankers and financiers control over the United States money supply and credit would lead to a situation where the bankers would be powerful enough to pauperize the people.

Charles A. Lindbergh Sr.

Why should Congress place a controlling agency [Federal Reserve System], employed for private gain, between the people and the Government of the United States? That is what has been done by giving to the banks the exclusive privilege of the use of the Government credit. Why is it proposed that the banker should take the merchants’, the manufactures’, and other notes, as well as the bonds of towns, villages, cities, States, and even the Nation’s bonds, to the Government and get currency, and at the same time refuse the producers themselves, the makers of the notes and obligations, an equal privilege? The absurdity of the Government giving away its own credit to corporations to exploit the people is incomprehensible. The bankers are not to blame. Congress is to blame for giving away the people’s rights and bestowing them upon the banks.

It is true that Congress possesses the authority and has the power to strip the banks of their exclusive monopoly, but the most of us have not the courage, and therefore we have the absurdity of the Congress of the United States giving to special interests the Government credit – the credit of the people – thereby forcing the people to borrow at exorbitant rates of interest the very money that their own Government issues on their own credit. The fiat of the Government is stamped upon the coins and the currency and then given to special interests and used as a means to pauperize the people. If the exclusive privilege were not given to the banks, then they would become the people’s natural agents, but with the exclusive monopoly they become the people’s masters.

Charles August Lindbergh Sr. (1859-1924)

Congressman from Minnesota 1907-1917

–Speech to House of Representatives Sept. 11 1913

Congressional Record Vol. 50 Part 5 pg. 4746

Along with Senator Nelson Aldrich there was Congressman Carter Glass pushing to get the Federal Reserve Act passed in the House of Representatives. Carter Glass was a vicious racist and loved using the law and the power of the government to gain privileges that would otherwise be unavailable. He incorporated his belief of white supremacy and using the power of the government to grant special privileges into the Federal Reserve Act. And it should be noted that in over one hundred years at the highest echelons of power at the Federal Reserve System there has never been an African American, Hispanic American, or any minority representative. Here is a quote so you can better understand the mindset of one of the founders of the Federal Reserve System.

Carter Glass

Discrimination! Why that is exactly what we propose—to discriminate to the very extremity of permissible action under the limitations of the Federal Constitution with the view to the elimination of every Negro who can be gotten rid of, legally, without materially impairing the strength of the white electorate. … This plan will eliminate the darky as a political factor in this state in less than five years.

Carter Glass (1858-1946)

Chairman of the House Committee on Banking and Currency

Report of the Proceedings and Debates of the Constitutional Convention, State of Virginia, 3076 (1906)

Edward Mandell House

December 19, 1912 I talked with Paul Warburg over the telephone regarding the currency reform. I told of my Washington trip and what I had done there to get it into working order.

March 27, 1913 Mr. J.P. Morgan, Jr., and Mr. Denny of his firm, came promptly at five. McAdoo came about 10 minutes afterwards. Morgan had a currency plan already formulated and printed. We discussed it at some length. I suggested he have it type written [so it would not seem too prearranged] and sent to us today.

January 21, 1914 After dinner we [Wilson and House] went to the president’s study as usual and began work on the Federal Reserve Board appointments.

Edward Mandell House (1858-1938)

Senior Advisor to President Woodrow Wilson

— Charles Seymour – The Intimate Papers of Colonel Edward House (New York: Houghton Mifflin Co., 1926 Vol. I)

Louis T. McFadden

Mr. Chairman, we have in this country one of the most corrupt institutions the world has ever known. I refer to the Federal Reserve Board and the Federal Reserve Banks. The Federal Reserve Board, a government Board, has cheated the Government of the United States and the people of the United States out of enough money to pay the national debt. The depredations and iniquities of the Federal Reserve Board has cost this country enough money to pay the national debt several times over. This evil institution has impoverished and ruined the people of the United States, have bankrupted itself, and has practically bankrupted our government. It has done this through the defects of the law under which it operates, through the maladminisration of that law by the Federal Reserve Board, and through the corrupt practices of the moneyed vultures who control it.

Louis T. McFadden

Chairman of the United States House Committee on Banking and Currency (1920-1931)

Speech in the House of Representatives 10 June 1932

John Maynard Keynes

Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security, but at confidence in the equity of the existing distribution of wealth. Those to whom the system brings windfalls, beyond their deserts and even beyond their expectations or desires, become ‘profiteers,’ who are the object of the hatred of the bourgeoisie, whom the inflationism has impoverished, not less than of the proletariat. As the inflation proceeds and the real value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless; and the process of wealth-getting degenerates into a gamble and a lottery.

Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.

John Maynard Keynes (1883-1946)

Economist

— The Economic Consequences of the Peace, Chapter VI. pg. 235-236, 1919

Ludwig von Mises

There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.

Ludwig von Mises (1881-1973)

Economist

Human Action [1949]

Carrol Quigley

In addition to these pragmatic goals, the powers of financial capitalism had another far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent private meetings and conferences. The apex of the system was to be the Bank for International Settlements in Basle, Switzerland, a private bank owned and controlled by the world’s central banks which were themselves private corporations. Each central bank, in the hands of men like Montagu Norman of the Bank of England, Benjamin Strong of the New York Federal Reserve Bank, Charles Rist of the Bank of France, and Hjalmar Schacht of the Reichbank, sought to dominate its government by its ability to control Treasury loans, to manipulate foreign exchanges, to influence the level of economic activity in the country, and to influence cooperative politicians by subsequent economic rewards in the business world.

Carrol Quigley (1910-1977)

Historian Harvard University

Tragedy and Hope: A History of the World in Our Time, pg. 277, 1966

Friedrich August von Hayek

Inflation is probably the most important single factor in that viscous circle wherein one kind of government action makes more and more government control necessary. For this reason all those who wish to stop the drift toward increasing government control should concentrate their effort on monetary policy.

Friedrich August von Hayek (1899-1992)

Economist Nobel Prize 1974

— The Constitution of Liberty, pg.338-339, 1960

Thomas Sowell

Despite all the political rhetoric today about how nobody’s taxes will be raised, except for “the rich,” inflation transfers a percentage of everybody’s wealth to a government that expands the money supply.

Moreover, inflation takes the same percentage from the poorest person in the country as it does from the richest.

That’s not all. Income taxes only transfer money from your current income to the government, but it does not touch whatever money you may have saved over the years. With inflation, the government takes the same cut out of both.

It is bad enough when the poorest have to turn over the same share of their assets to the government as the richest do, but it is grotesque when the government puts a bigger bite on the poorest. This can happen because the rich can more easily convert their assets from money into things like real estate, gold or other assets whose value rises with inflation.

But a welfare mother is unlikely to be able to buy real estate or gold. She can put a few dollars aside in a jar somewhere. But wherever she may hide it, inflation can steal value from it without having to lay a hand on it.

No wonder the Federal Reserve uses fancy words like “quantitative easing,” instead of saying in plain English that they are essentially just printing more money.

Thomas Sowell (1930- )

Economist

— “Taxing the Poor” Creators Syndicate Inc. Written 10 December 2012

Andrew Jackson

I too have been a close observer of the doings of the Bank of the United States. I have had men watching you for a long time, and am convinced that you have used the funds of the bank to speculate in the breadstuffs of the country. When you won, you divided the profits amongst you, and when you lost, you charged it to the Bank. You tell me that if I take the deposits from the Bank and annul its charter I shall ruin ten thousand families. That may be true, gentlemen, but that is your sin! Should I let you go on, you will ruin fifty thousand families, and that would be my sin! You are a den of vipers and thieves. I have determined to rout you out and, by the Eternal, I will rout you out.

Andrew Jackson (1767-1845)

7th President of the United States

— From the original minutes of the Philadelphia committee of citizens sent to meet with President Jackson, February 1834, according to Stan V. Henkels, Andrew Jackson and the Bank of the United States, 1928

Daniel Webster

Of all the contrivances for cheating the laboring classes of mankind, none have been more effectual than that which deludes them with paper money. This is the most effectual of inventions to fertilize the rich man’s field by the sweat of the poor man’s brow. Ordinary tyranny, oppression, excessive taxation – these bear lightly on the happiness of the mass of the community compared with fraudulent currencies and the robberies committed by depreciated paper. Our own history has recorded for our instruction enough, and more than enough, of the demoralizing tendency, the injustice, and the intolerable oppression, on the virtuous and well disposed, of a degraded paper currency, authorized by law, or in any way countenanced by government.

Daniel Webster (1782-1852)

Senator

— Statement to Senate – 1832

More Artwork